It could be more than a million-dollar question. Where are the current farm loan interest rates going to go? How fast are they going to get there? To help us answer some of these questions, Tractor Zoom tapped Tanner Winterhof, co-host of the popular Farm4Profit Podcast, as well as a loan officer from Ames, Iowa, to help provide some insights into what the industry can expect.

Time to Manage Interest Rate Risk

We are coming out of a point of record low interest rates for a record length of time. These low rates were used as a mechanism to either boost or stabilize the American and worldwide economies. However, now that we have an economy that is growing and pushing inflation rates higher, the Fed or “Central Bank” had initially made it known they planned to raise rates 4 times during 2022 starting in January. However, how much rates increase and whether the planned number of increases will remain as announced is up in the air considering the existing geopolitical risk of Russia’s invasion of Ukraine.

Right now, if farmers and business owners haven’t already done so, most of the population is scrambling to make sure their interest rate risk is protected. What is interest rate risk? This is the risk experienced by having money borrowed on terms that allow for an interest rate adjustment at some point before the maturity or finality of that loan. This rate could be adjusted daily, monthly, or at some period in the future. Depending on your farm or business, you will ultimately determine the amount of risk you can handle.

If you haven’t already made changes to manage your interest risk, how quickly do you need to call up your banker? This leads to the questions we started with. Where are interest rates going and how quickly will we get there? I can tell you the market is already adjusting and it isn’t waiting for an announcement from the Fed to make changes. Rates have been trending upward steadily since the beginning of 2022.

Looking to the Past to Plan for the Future

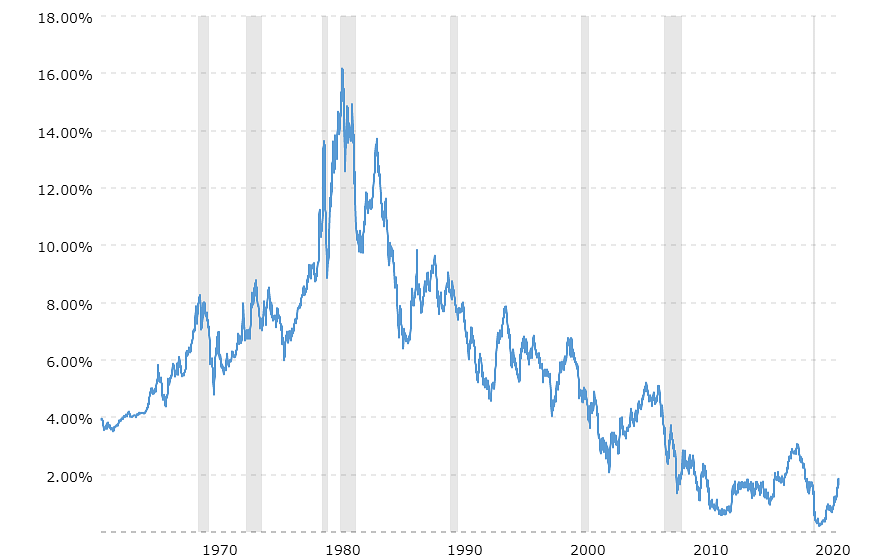

The chart below is borrowed from Macrotrends and depicts the historical yearly average for the 5-year treasury rate. At a quick glance the rate looks extremely volatile. However, when you look at where it has been and where it is now, the 5-year rate has been over 4% for 45 of the last 60 years. Currently, the 5-year treasury rate is at 1.55% up from a low of 0.21% in July of 2020. A climb to a position above 4% would represent an over 250% increase from where we are today.

The “when” target will be the biggest challenge to figure out as we know we are probably headed to a point 250% or more higher than our current environment. Depending on the growth in the economy, worldwide inflation, the trust in our government’s monetary system, our nation’s unemployment, and many more economic measurements the when will soon be revealed. Then, and only then, will we know the impact rising rates will have on the purchasing power for those owning and operating farms and businesses.

For now, it’ll continue to be critical to make informed purchase decisions using the data at your disposal.